If you work in sustainability/CSR/ESG it’s pretty certain you’ll have been asked what’s in it for me? Perhaps more commonly this may be phrased as ‘I can see this is important – but what’s the business case for sustainability?’. There’s sometimes a subtext – ‘yes I can see how this may be important for many people, but what does it mean in a business context?’ While the separation between what happens in the real world and within ‘boardrooms’ is sometimes puzzling for some of us, businesses leaders often struggle with seeing the value.

What is my business case for sustainability?

While some companies continue to view sustainability largely as a cost centre, it should really be seen as a value protector and driver which can deliver a range of commercial benefits. Depending upon your business’s sector and competitive positioning these benefits will lie in one or more of four key categories:

Revenues & earnings

Sustainable innovation can create new products or markets and provide your organisation with performance characteristics, market recognition and differentiation.

Cost

Environmental efficiency and cost are closely aligned. Some of the fundamental resources which all businesses rely upon (energy, water, raw materials etc.) are becoming volatile in terms of price and supply. Lower risk businesses, those who move ahead of regulation and those who move to service future customer requirements and look after their suppliers and staff are likely to have save costs through lower insurance premiums and access to lower costs for capital.

Risk

Identification, assessment and management are common business processes and can provide a vehicle for understanding sustainability issues in the language of business risk – or opportunity.

Intangible value

Company governance expert Mervyn King suggests that 80% of average company value is non-financial. This refers to ‘soft’ issues not directly featured on balance sheets such as leadership, transparency, intellectual & human capital, and culture. Together these contribute to the company’s ability to continue delivering value into the future. Sustainability issues have been identified among the top-ten drivers of intangible value.

Missing the obvious – sustainability blind spots

Each of the category areas above will already be subject to analysis and management by companies and investors. However, this does not mean that such analyses will be identifying the value protection or creation capabilities of sustainability.

This can be for two reasons:

- Narrow horizons

This refers to an inability to see how big picture sustainability trends impact on individual companies, and therefore only including a relatively narrow set of traditional business planning criteria in strategic analyses. A simple way of dealing with this is to adapt mainstream strategic assessment tools such as Porter’s 5 Forces, and expand them to include a wider scope of issues.

- Narrow timescales

Building long-term value and resilience can require longer investment periods or more crucially longer payback periods than usual. Some companies frequently base policies on their investment/return requirements. Typically, this can be three years. A few years ago, we came across an oil and gas company that recognised their standard cost-benefit model payback time of break even within 3 years was a barrier to investment in sustainability. They changed their policy to allow break-even after 7 years, opening the door to a much greater focus on long-term value and a range of cost saving and impact reducing projects.

Building a strategic approach to the business case for sustainability

Few companies would argue that the next half century will not see trends that will reshape the nature of business. These trends will be dominated by sustainability concerns such as physical limits to growth, resource availability, climate change, social and demographic changes and increased, dynamically changing patterns of demand.

The long-term case for sustainable business is therefore one which is relatively easily made.

The challenge which companies still struggle with is the short to medium term case. Here are few tips for developing a more strategic approach to your business case now.

STEP 1

Consider the following issues, the changes they will bring to customer needs and demands, society and citizens, what will they mean for your sector and your company in 5/10/25/50 years?

- Climate change

- Emerging evidence on planetary boundaries

- Population growth and changing demographics (as drivers/workforce/customers)

- The need to tackle air, water and ground pollution

- Regulatory objectives

- Policy objectives, e.g. SDGs, de-carbonisation

- Artificial intelligence, block chain and automation

- Genetic modification and bioengineering

- Values and ethics

- Supply chain employment conditions, slavery, child labour

- Toxic/problematic compounds in manufacture/products

- Specific industry issues – e.g. plastics use and pollution

STEP 2

Taking your thoughts/notes from Step 1, in each of the suggested categories:

Consider what this may mean for your company in terms of:

- Costs

- Risks

- Reputation, values and responsible behaviour

- Meeting current/emerging customer demands

- Regulation

STEP 3

Now it’s coming to the crunch, after all you’ve considered:

Is business as usual viable for you in 5/10/25/50 years?

Building the business case for sustainability

Each of these can help you explore and map out different elements of the business case for your organisation. It can be difficult to convince people about things you understand, so include key people in your analysis and exploration.

Change is often difficult but it’s key to remember that business as usual, deciding to do nothing, is also a choice, and one that will have consequences.

How much time do you want to spend on the business case – and how much on building a better business that’s fit for the future?

DISCOVER MORE | Sustainable Business Strategy

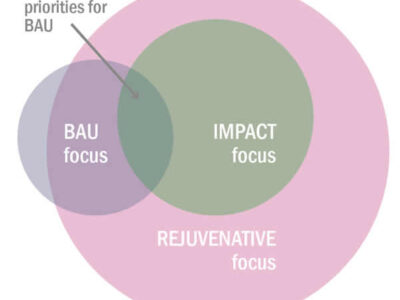

Setting Sustainability Ambition

A well-defined sustainability ambition is central to effective strategy and long-term value creation. It outlines where a company will focus its sustainability efforts, what it aims to achieve, and the pace of progress. By integrating strategic direction, material focus, operational planning, …

Why we should be reinforcing sustainable strategy in challenging times

Sustainability professionals face mounting challenges as global pressures, climate change, ecological degradation, and social inequality, intensify. At the same time, corporate focus and resources for sustainability are under strain due to shifting political and economic priorities.

To drive …

WEF Global Risks 2023 – What’s new and what’s changed?

While big picture environmental threats of climate change, nature loss and ecosystem collapse remain long term risks, geopolitical instability and the current cost-of-living crisis challenges present emerging challenges to the chance for global consensus and coordinated action.

The WEF (World …

2023 sustainable business trends and challenges – what to watch out for

From avoiding greenwashing to facing soaring business costs, 2023 is set to be a challenging year for most business leaders to navigate.

Regulators, customers and consumers have increasing expectations for good quality, consistent information on sustainability. Communication must be accurate and …

Global Risks 2022

Most major sustainability issues have important risk dimensions for companies – and societies. In many cases these are still not adequately represented in board-level discussion, company risk assessments or registers.

WEF’s Global Risk Report provides a very useful, comprehensive global review and …

Biodiversity – the next crisis?

While we’ve been concerned with action on climate and tied up with Covid19, a larger, related crisis is brewing. Businesses are waking up to the need for action on biodiversity.

Biodiversity is one of many issues organisations should consider when developing (or reviewing) sustainable business …

Transforming the business case for sustainability

In a business context it’s often been necessary to justify why sustainability is important with a business case. While it gets less visibility now, it’s still common to see the symptoms of not having a good business case, or one that’s not widely implemented.

Materiality Matters

Materiality is the difference between a weak sustainability approach and one that’s logical, planned and based upon what’s important. What matters most?

Cost or value? Why is sustainability strategically undervalued?

Cost or value? Why is sustainability strategically undervalued?

Leave a Reply