Energy economics as if thermodynamics mattered…

The constitution of the universe

“Everything you are, and have, you owe to the radiations from your sun.”

Chocky (John Wyndam)

The behaviour of energy in systems is described by the laws of thermodynamics, perhaps the most fundamental expression for the frame for physical existence. Indeed, Sir Arthur Eddington said of the 2nd law: “There is only one law of Nature – the second law of thermodynamics – which recognises a distinction between past and future more profound than the difference of plus and minus.”

The Laws of Thermodynamics provably frame and shape our scope for existence, yet they are effectively ignored by economic policy and process.

The first and second laws of thermodynamics describe the fundamental physical principles of the behaviour of energy. The 1st law refers to change in energy states, the 2nd law to energy dispersal, which can be expressed as follows: “energy of all kinds in our material world disperses or spreads out if it is not hindered from doing so.”

To use a metaphor, energy is like water, it only moves in one direction: towards dispersal (energy) or downhill (water). However, not all water moves downhill at the same speed, just as not all energy flows from concentrated to dispersed forms at the same rate.

The measure of the dispersal predicted by the 2nd law is entropy. As entropy applies without exception to all energetic processes, it can provide a common metric to measure the lifetime performance of different energy sources.

Why isn’t overall thermodynamic performance part of energy economics?

Despite recent advances in renewable production, fossil fuels still make up more than 80% of our planet’s energy use. There are some good, practical reasons why coal, oil and natural gas (CONG) dominate supply in the global economy. Most significantly, CONG provide concentrated, transportable sources of utilisable energy.

However, this ease of use distracts us from their lifetime energetic (entropic) performance: that is, how efficiently they capture, store and render the sun’s energy over their lifetime.

We tend to think of CONG as energy itself, but this is not accurate. They are storage media for concentrated solar energy which was aggregated by photosynthesis in prehistoric vegetation and then subjected to nearly 100 million years of geological process. In conceptual and literal terms they are natural batteries, comparable to a lithium ion battery storing energy derived from solar PV.

The Sun is the original source of almost all energy, arguably excepting nuclear, geothermal and tidal. This common origin provides the opportunity to derive like-for-like comparisons of energy sources.

Comparing the entropic performance of energy sources provides us with a way of assessing and therefore pricing the total efficiency of a wide range of energy sources. This could be called ‘entropic valuation’.

Why entropic valuation matters

Entropic valuation is a means to compare the total energetic efficiency of solar derived energy sources, it considers: “How many solar kilojoules (kJ) have gone into this storage media in order to obtain 1 kJ of usable energy from it?” This ratio can then be used to assign a nominal price to the results.

If common solar origin is considered for a range of energy types then a very different picture of value and efficiency emerges. For example, if we consider the conversion of solar kilojoules into usable kilojoules, then solar PV is circa 100,000 times more efficient than oil.

This may be technically correct, but what difference does it actually make? After all, while CONG includes many million years of investment, we don’t pay for that time and can simply reap the benefits of its existence. However, there are compelling reasons to explore the real total energetic (entropic) performance of different energy sources.

Benjamin Franklin wrote that “the great part of the miseries of mankind are brought upon them by false estimates they have made of the value of things”.

The false estimates that we make of the value of fossil fuels blinds us to the challenges which arise from their use. Beyond the pollution impacts of burning irreplaceable stored energy, the belief that fossil fuel energetically outcompetes other sources of energy has lead to distorted markets and incentives to pursue resources that are ever harder to exploit.

Projects such as Carbon Tracker have begun to highlight the extent of the problem, calculating that only 20-40% of carbon assets held by listed companies could be burnt without exceeding global warming of 2°C. Yet the worth currently assigned to these assets can only be realised if they are used. In our current industrial model this would be a onetime use: valuable in the short term, but catastrophic in both planetary and financial terms in the future.

Applying entropic valuation to differing solar derived energy sources reveals that fossil fuels carry sunshine at a much lower rate, in terms of original energy received, than the real-time production of solar PV and storage.

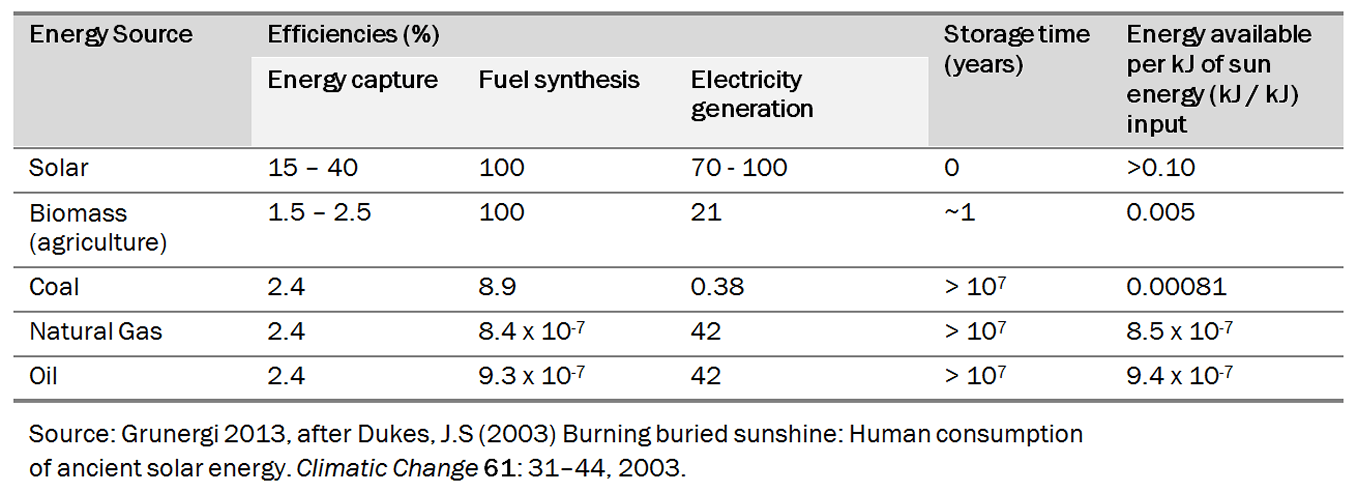

The above table compares the energy conversion (of solar input) efficiencies of a number of energy sources. Put simply, coal, oil and natural gas capture only 2.4% of solar input received, while solar PV captures vastly more, varying between 15 and 40%.

This ‘capture gap’ is compounded through the geological translation of ancient vegetation into concentrated fossil fuel, meaning that while every KJ of sun energy received by solar PV produces around 0.1kJ of usable energy, oil produces only 0.00000094 kJ – more than 100,000 times less!

This analysis highlights an interesting relationship between the energetic efficiency of ‘real-time’ or ‘live’ energy generation and that of fossil fuel energy generation.

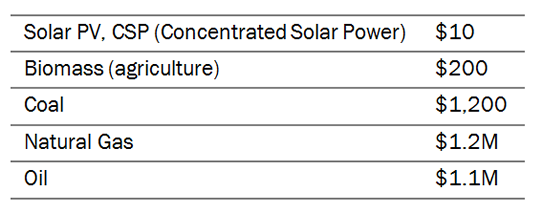

These differences can be translated into money. Using the relative efficiency figures from the table above, energy sources can be priced on an equal basis. If each input kJ of Sun energy cost $1, the product energy price required to break-even per kJ produced are shown here:

The whole picture – don’t forget the externalities

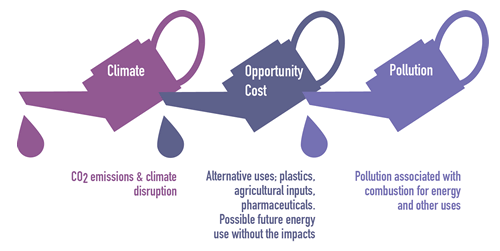

While comparisons of total energetic performance are dramatic, we should also remember that significant external costs arise from the use of CONG.

These costs, rarely integrated into the actual price paid for energy, exist across a range of “balance sheets” and consist of the following dimensions:

- Climate impacts – the contribution of CO2 and other emissions driving climate disruption.

- Pollution – direct impacts from extraction, production and refining in addition to combustion emissions for energy and other uses.

- Opportunity costs – one time use of such complex, time-rich compounds precludes a huge range of other uses, for: plastics, agriculture, pharmaceuticals and possible future technologies.

There appears to be a correlation (but not necessarily a causal link) between energetic performance and the scale of these externalities. While climate and pollution costs are well documented, the huge differences in energetic performance perhaps highlight the scale of opportunity costs incurred by our predominantly “one-time” use of fossil fuels.

Towards real-time energy

Francois de La Rochefoucauld noted that “The principal point of cleverness is to know how to value things just as they deserve.”

It is just such intelligence that humanity must apply to the environmental and energy challenges of the coming decades.

Clear and unarguable environmental and resource trends indicate an overwhelming need to connect energy pricing with the fundamental realities of physics in terms of:

- overall energetic performance

- longevity & replenish-ability

- cleanliness/pollution

- significant/irreversible opportunity costs

Entropic valuation provides a means to connect these aspects, founded in immutable physical law.

Entropic valuation reveals the orders of magnitude difference between the life time efficiency of “live” solar generation and the ‘stored sunshine’ of fossil fuels.

It suggests that truly sustainable solutions lie in growing ‘real-time’ energy and moving rapidly away from our dependence on upon finite, and borrowed, prehistoric time.

It’s time we paid rather more mind, and money, to entropy.

Entropic Valuation is idea developed by Joss Tantram in conjunction with Sean Grunnet Cuthbert and first tested in public at the Energy Storage World Forum, Berlin, April 2013. Our motivation in developing the idea was to explore new ways of looking at old problems and to connect energy perspectives with the energy reality defined by the laws of thermodynamics.

A slightly shorter version of this article was first published by Green Futures Magazine on 3/02/14.

Leave a Reply