Twenty years ago, the business case for sustainability was big. Within a business context it was often necessary to justify why pursuing sustainability was important, worthwhile and how much it would cost.

It gets less visibility now, but it is still common to see the symptoms of not having a good business case, or one that’s not widely implemented.

More noise than transformation

Sustainability in business is now commonplace, it’s a normal part of doing business so it is not seen as being radical or ahead of common practice.

Except it isn’t.

There is still only a minority of businesses doing sustainability well or in a meaningful manner. Some have good intentions but struggle to get their initiatives moving or keep developing them.

Others are doing components very well – but fail to focus on the material (priority) issues. For example, they might focus on employee engagement, recycling or philanthropy (all important issues) but not the huge impacts arising from their business model/supply chain.

So, while the business case has assumed a lower profile the need for it, in different forms, is still very much present.

What is a business case for sustainability?

So, what is a business case for sustainability? Is it always financial, rather dry and technical and best assembled by economic analysts?

Or is it a business focused approach to ‘doing the right thing’?

In practice it can be either or both and it depends upon the emphasis and more importantly the ambition behind the business case.

Defining different business case types

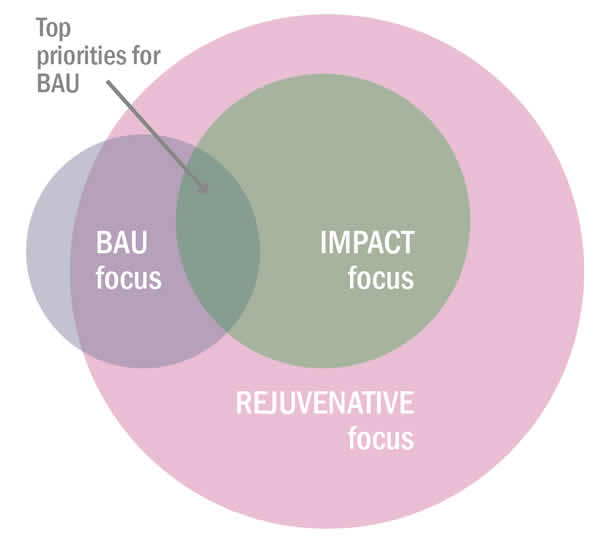

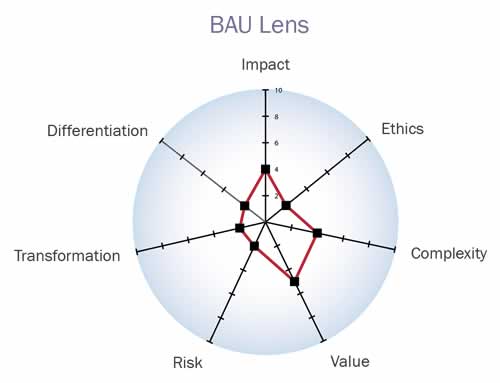

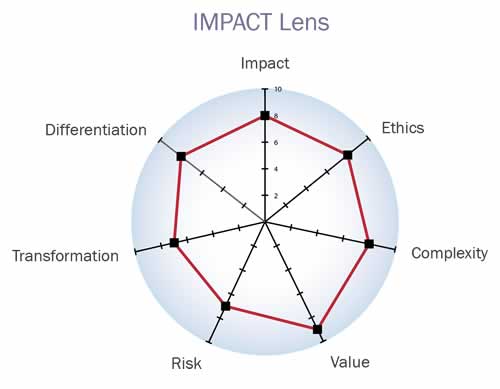

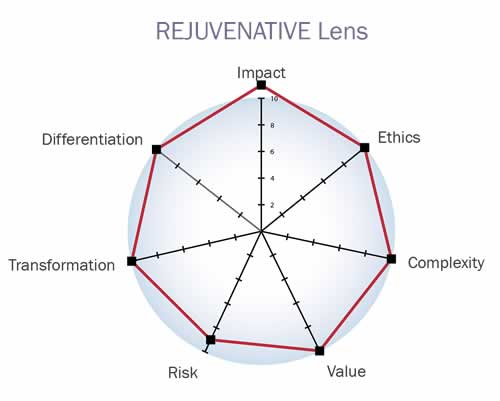

The nature of the business case depends largely upon the ‘lens’ you are working through. Here I suggest three possible lenses for the business case for sustainability. Of course, these are generalisations, but they can be seen in everyday practice. I’ve also given nominal scores on different related aspects of performance to allow exploration (a higher score represents better performance – i.e. a higher risk score represents better risk management).

BUSINESS AS USUAL Lens | mainly current financial focus

This follows the rationale of ‘what is the best we can achieve within financial constraints?’

The BAU Lens is where organisations often begin, it’s focused around changing little but seeing where sustainability, responsibility and ethics can be squeezed in or added on.

It tends to represent an incremental approach to change and some possible solutions and activities are ruled out on financial terms.

IMPACT Lens | changing business focus

This asks ‘What is the best we can achieve?’ and therefore ‘what it is the business case for delivery?’

The Impact Lens is more ambitious. It is arguably a more ethical approach, based upon more realistic harm reduction. As a result, it is more likely to produce greater business advantage and risk reduction. However, it is likely to be more complex and difficult.

It tends to represent a more transformative approach, possible solutions and activities are ruled in on impact terms, financial aspects are often adapted to accommodate.

And emerging is a third version…

REJUVENATIVE Lens | transformative business focus

This aims for and beyond sustainability, for removing negative impacts and creating positive social and environmental utility. Driven by a true understanding of sustainability context, this aims for a truly and often radically transformative agenda.

How do different case types differ?

Which business case approach you pursue will depend upon your business’s strategy and level of ambition. Many businesses start with an incremental approach and lean into a more transformative agenda. As awareness and expectations of environmental dependencies grow, limited, incremental approaches are less likely to bring the changes needed or lasting business advantage.

If we look at the mainstream definition of a business case – there’s one key aspect that’s often overlooked – it should consider the costs and risks associated with business as usual. For ease, psychological bias and practical reasons the risks associated with apparently doing nothing, or maintaining the status quo are often downplayed.

Where sustainability continues to be seen as a cost rather than a source of value, this is likely to persist. Until that’s overcome a more financial lens will continue to be the norm.

DISCOVER MORE | Sustainable Business

Avoiding strategic greenwashing – why your business strategy must be plausible

Worldwide regulators are tightening up on strategic greenwashing to protect consumers, business and market integrity. As further examples arise there is more, we can learn about what regulators will tolerate and what they require of companies.

Put simply, any leeway for general feel-good …

WEF Global Risks 2023 – What’s new and what’s changed?

While big picture environmental threats of climate change, nature loss and ecosystem collapse remain long term risks, geopolitical instability and the current cost-of-living crisis challenges present emerging challenges to the chance for global consensus and coordinated action.

The WEF (World …

2023 sustainable business trends and challenges – what to watch out for

From avoiding greenwashing to facing soaring business costs, 2023 is set to be a challenging year for most business leaders to navigate.

Regulators, customers and consumers have increasing expectations for good quality, consistent information on sustainability. Communication must be accurate and …

Global Risks 2022

Most major sustainability issues have important risk dimensions for companies – and societies. In many cases these are still not adequately represented in board-level discussion, company risk assessments or registers.

WEF’s Global Risk Report provides a very useful, comprehensive global review and …

Biodiversity – the next crisis?

While we’ve been concerned with action on climate and tied up with Covid19, a larger, related crisis is brewing. Businesses are waking up to the need for action on biodiversity.

Biodiversity is one of many issues organisations should consider when developing (or reviewing) sustainable business …

Materiality Matters

Materiality is the difference between a weak sustainability approach and one that’s logical, planned and based upon what’s important. What matters most?

The business case for sustainability – can we make money?

Many people are driven by purpose, the ethical dimension of sustainable business. But all businesses need to make money, we explore where value can be found in sustainable business.

Cost or value? Why is sustainability strategically undervalued?

The business case for sustainability is (shockingly) still either not recognised strategically (i.e. it is understood as an additive factor for operational efficiency or marketing/PR but not as a strategic value creation/destruction factor), or in many cases it is little understood at all.

Biodiversity and business is for the birds

Biodiversity and business is for the birds

Leave a Reply